The holiday season should be all about gifts, celebrations, and time with loved ones. However, it’s also prime hunting season for scammers.

Cybercriminals are exploiting the online shopping and travel booking rush. They use convincing fake deals, phishing scams, and social media traps to steal your personal information. Unfortunately, their modern tactics are so slick that they can even fool experienced users.

This guide breaks down the most common holiday scams to watch for and shows you simple ways to avoid them. With a few smart precautions, you can protect your identity, your bank account, and your peace of mind (so you can actually enjoy a stress-free holiday).

Quick overview of the most common holiday scams

In a rush? Here are the 15 most common holiday scams that you can encounter (with jump links to each scam’s detailed section):

- Package delivery phishing scams

- Fake online retailer websites

- Gift card scams and draining

- Holiday charity scams

- Social media shopping scams

- Phishing emails and texts

- Seasonal job scams

- Too-good-to-be-true scams

- Fake shipping notifications (smishing)

- Counterfeit goods scams

- Holiday travel scams

- Identity theft and account takeovers

- Unsafe public Wi-Fi scams

- E-card and holiday E-greeting malware

- Grandparent/family in distress scams

How do holiday scams work, and how bad are they?

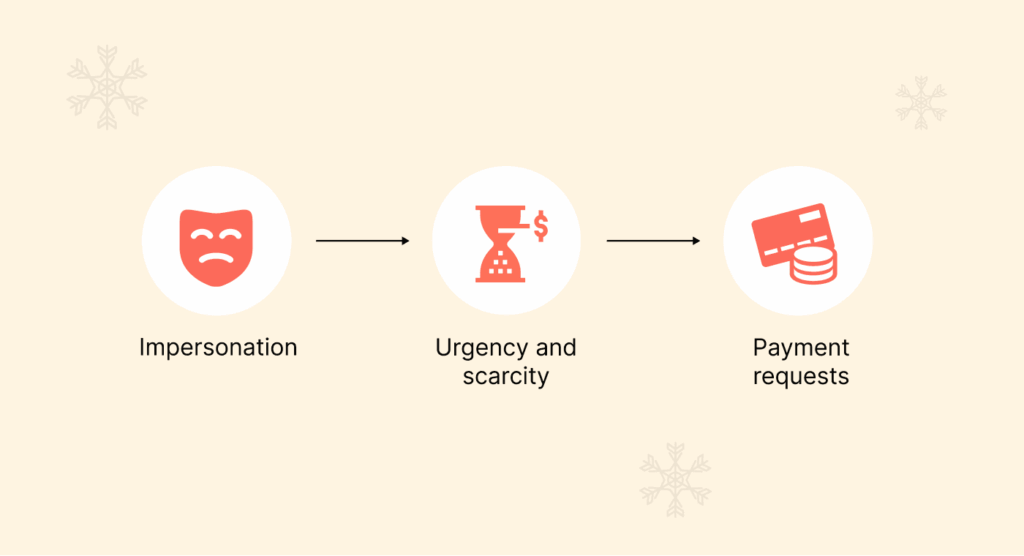

The actual mechanics of holiday season scams are quite simple, yet staggeringly effective. They work on two simple principles: they target human emotion, and they utilize common holiday traditions.

The scammer knows you are busy, likely experiencing some level of stress, attempting to purchase gifts, and now checking your phone in anticipation of the delivery. Scammers have leveraged this behavioral mix to create tactics such as:

- Impersonation: Pretending to be large retailers, banks, delivery companies (such as FedEx or USPS), or even family, creating misguided pseudo-trust.

- Urgency and scarcity: Scammers create panic with alerts like “Your package can’t be delivered!” or “This sale ends in 5 minutes!” The goal is to make you react on emotion. That shuts off the critical part of your brain, so you’ll click or send money without thinking.

- Payment requests: The requests for payment types untraceable or reversible (if at all), such as a gift card, a cryptocurrency, or a wire transfer, are indicative of a scam.

How bad is the impact of holiday scams?

Because of the scope of the holiday scam damage, the data show significant shortcomings in holiday scam preventive measures. Various data sources, such as the FBI and several consumer protection agencies, invariably record a rise in acts of fraud during the festive seasons.

According to a 2024 report, financial losses amount to hundreds of millions of dollars annually, the highest losses being due to non-delivery and non-payment scams. But the money is only part of the problem–the emotional pain is horrible; hoarded savings get wiped out, identity fraud (identity theft), and stress can spoil the holiday season. That’s why taking preventive and protective steps is a necessity, so you’re not one of those statistics.

15 specific holiday scams and how to prevent them

Here’s a thorough breakdown of the most common prevention challenges associated with holiday scams, what to watch for, and how to avoid them:

1. Package delivery phishing scams

Potentially the most popular type of holiday scam, package delivery scams capitalize on the number of packages being sent during the holiday season. Here’s how it works: a scammer sends you an email that looks legit, as if it came directly from FedEx or UPS. It will say there’s an issue with a package—like a late delivery, an unpaid (or late) fee, or a missing address—all to create urgency and get you to click.

The goal is to have you click on the link to either steal your login information (and eventually identity or banking information) or install malware on your device. This is a classic type of holiday scam that creates urgency.

Warning signs

- Urgency and fees: The message warns that unless you quickly pay a small “re-delivery fee,” the company will return or dispose of your package.

- Similar but suspicious domain links: Watch out for links in emails or texts where the website name is off by a letter, sounds weird, or is just totally different than what you’d expect (like “fedex-tracking.com” instead of the real deal).

- Random alerts: Getting a delivery alert from a shipping company you don’t know or for something you didn’t order.

Prevention measures

- Direct verification: You should never click any link in the notification. If your message does have a tracking number, copy it and paste it into the official website of the carrier (UPS, FedEx, Amazon, etc.), or use the retailer’s official app.

- Use their official apps: Only use the carrier’s specific mobile application for tracking and delivery management, to steer clear of any links in any messages.

- Use a VPN on public WiFi: In case you check emails using public WiFi while out and about running errands, use NordVPN to encrypt your connection so that hackers may not be able to see your screen or your information if you mistakenly click and access malicious links.

2. Fake online retailer websites

Scammers create e-commerce websites that look like real online stores. Sometimes they will go as far as replicating the photos of the products and the layout from legitimate brands.

The scams typically involve expensive items or the hottest electronics at prices that seem ridiculously low. And fall victim to these types of online retailer scams all the time during the holiday shopping frenzy, when people are trying to score great deals on the greatest items, but are still concerned about missing out later.

You pay for the fake products and get nothing, or even worse, you find out that you paid for something and now your payment information has been taken or compromised. Scammers are very good at creating holiday season scams with such fake online retailer outlooks.

Warning signs

- Misspelled URLs: The web domain is slightly different from what you expect, like Nikkke.com instead of Nike.com, or it uses an uncommon domain extension like .net or .xyz instead of the more popular .com.

- Too-good-to-be-true prices: Whether it is for a high-demand item like a new gaming console or designer handbag, if a price is offered at 50% off, or even more, be suspicious. If it seems too good to be true with major retailers, it likely is.

- Unsafe payment options: Only accepts payment through Traceable methods, meaning methods such as Wire transfer, accepting cryptocurrency, or gift cards. Well-known retailers would only accept major credit cards, which have a customer support center.

Prevention measures

- Check for HTTPS and contact info: Always check for the padlock icon and the “https://” in the URL bar. You need to verify they have a physical address, a working phone number, and have stated their return/refund policy (or download their app).

- Researching before payment: Look up the website name (plus “scam” or “review”) to see if anyone has publicly posted warnings about being scammed before you provide payment information.

- Pay with a credit card: Only use a credit card to make payments instead of a debit card; credit cards have much better fraud protection and your right to dispute a fraudulent charge to ensure reversal.

3. Gift card scams and draining

Gift cards are a holiday tradition, but they are becoming increasingly popular with scammers. Scammers often target these gift cards by simply tampering with the physical card while it is on display. They will record the number and private identification number (PIN).

Once a customer purchases and loads the card, the thief uses an automated script to check the balance and drain the funds almost instantly. Gift card payment requests are also a hallmark of imposter scams.

Warning signs

- PIN exposed: Take a close look at the back of the card. If that silver scratch-off strip looks messed with or has a weird sticker on it, that’s a major red flag.

- Payment requested: A fake bank, utility company, or government agency is requesting that you pay a fee or fine using a specific gift card (for example, an Apple or Google Play gift card).

- Unusual packaging: The packaging of the gift card looks as if it has been opened, re-glued, or has tiny bar code stickers over where the bar codes should be located.

Prevention measures

- Buy from behind the counter: Only buy gift cards that are kept behind the counter, and have the clerk retrieve one for you directly from storage. Avoid cards sitting loosely on easy-access racks.

- Treat gift cards as cash: Keep in mind that once the gift card number is given away, the funds are tracked and cannot be refunded. Legitimate businesses/agencies will never ask for a gift card for payment.

- Preserve the receipt: Be sure to preserve the receipt issued from activation that indicates the time, date, and amount on the gift card that you activated.

4. Holiday charity scams

In many cases, scammers create a fake charity to take advantage of people’s willingness to give this holiday season. They will generally promote charitable giving through social media or email during the holiday season.

The con artists usually solicit donations by giving either a “sad” story or a “heartwarming” story. The bad news is that if you give, those funds will go directly to the scammer’s pocket and not to benefit a charity, relieve suffering, or provide for someone in need.

Warning signs

- Pressure and urgency: The solicitor attempts aggressive tactics, implies immediate payment is required, and/or makes you feel guilty for questioning their legitimacy.

- Nothing or vague information: The charity’s website has no specific details about their donation policy, has poor grammar on the website, or does not list official tax ID numbers or any address.

- Unverified payment methods: They have money transfer through cryptocurrency or cash as their payment method. Legitimate charities will accept checks, credit or debit card payments, or donations through a verified, secured donation site.

Prevention measures

- Check out the charity: Organizations like Charity Navigator or the Better Business Bureau (BBB) Wise Giving Alliance are built with official resources. Use them to verify the organization’s registration and transparency.

- Do not click links: If you received an unsolicited email, DO NOT click on any links that they provide. Instead, you can search for the legitimate, verified charity you would like to support in a browser and review it from there.

- Check the tax status: If you’re in the U.S., you can switch to the IRS Tax Exempt Organization Search to see if your charity is not a scam and that it does not deduct tax from your contribution.

5. Social media shopping scams

You are scrolling manually through Facebook or Instagram and see an ad for a big discount on a holiday must-have item. These ads usually have a high-quality video or image that was lifted off of a legitimate brand’s site and then points you to a fake retailer site.

Scammers are relying on impulse buying and a lack of vetting capabilities as a deterrent to their crime. Social media shopping scams are an emerging threat to holiday shopping.

Warning signs

- New or low-follower account: You can often spot a scam if the account running the ad is brand new and has almost no followers (or if its comment section is filled with warnings from people who’ve already been ripped off).

- Generic images: The product images look professional, but the account created by the scammer uses a generic logo, or the photo has few organic posts other than a paid ad.

- Social obligations: The deal is predicated on your tagging friends, sharing the post, or doing some other task before clicking the link, which serves as a means to disabuse the scam quickly.

Prevention measures

- Search the brand directly: If you see an amazing deal, ignore the link in the ad. Open a new tab in your browser and search the retailer’s official website to determine if the social media promotion is legit.

- Watch the engagement: Scroll through some of the engagement history of the account. If it’s mostly just reposts or ads with no authentic customer engagement, treat it with extreme suspicion.

- Use a dedicated card: When shopping from an unfamiliar online store, use a dedicated credit card or a virtual single-use card number with a small limit. This limits your financial exposure if the site is fraudulent.

For a deeper dive into platform-specific tricks, our guide to the top Facebook marketing scams breaks down exactly how these fake ads and pages operate and how to spot them before you click.

6. Phishing emails and text messages

Phishing is the broad designation applied to fraudulently using fake communications (email, text, or phone) to induce you to relay personal information. During the holidays, these communications often act as your bank, a payment service (such as PayPal), or some major retailers (Amazon, Apple). They could claim either a security breach, an account suspended, or an outstanding account invoice.

Warning signs

- Sense of panic: The correspondence uses alarmist language, “Urgent action required!” The message warns, “Your account will be frozen in 24 hours.” By design, this urgent language makes you panic and bypasses your rational thinking.

- Credential request: The email sends you to a page that requests you to “verify” your password, Social Security Number, or credit card information. It is important to note that authentic companies will never ask for this type of correspondence via email.

- Grammatical errors: Even with the advancement of AI, many phishing emails have awkward phrasing, poor grammar, as well as capitalization issues.

Prevention measures

- Check the sender’s email: By going over the mouse on the sender’s email address, you can identify slight misspellings, obscure symbols to appear to be official email addresses, or domains that do not appear to be authoritative with the official seller (example: amazon-support@gmaill.com).

- Log in directly: If you think the message has the possibility that it is real, do not click the link; instead, open your web browser and type in the company URL search to log in to your account and see if there are any alerts.

- Use multi-factor authentication (MFA): Be sure to have MFA enabled for all financial and shopping accounts. Even if scammers stole your password via a phishing link, they won’t be able to log in without the code from your phone.

7. Seasonal job scams

Many retailers and shipping companies hire extra help for the holiday season scams. Scammers exploit this by posting fake job listings that promise high pay for little work.

They “hire” you quickly, then ask for sensitive personal information (Social Security Number, bank account details for direct deposit) to “start the onboarding process” or require you to pay a fee for a “background check” or training materials.

Warning signs

- Immediate hiring without interview: The hiring experience feels hurried, and you get a job offer without any actual interview or video conversation, which is highly unlikely for legitimate seasonal employment.

- Request for fees: Any request for money for materials, training, or a job guarantee is a huge red flag. Legitimate companies pay you; you don’t pay them to work.

- Excessive wage for the work: The hourly pay is far in excess of what most package sorters or retail workers typically make, indicating this is likely an offer to entice you.

Prevention measures

- Verify the company’s hiring page: Always go directly to the retailer’s official website to verify the job listing. For example, go to UPS Careers and see if they actually posted the job. If you see an ad on a third-party site, never apply through it—use the company’s direct website instead.

- Never share financial information early: Do not provide bank account or SSN details until you have physically signed an official employment contract and verified the identity of your hiring manager.

- Keep an eye on your credit: Scammers want your identity and info, so check your credit report for anything weird right after you deal with a sketchy job offer.

8. Too-good-to-be-true deals

This scam uses a psychological approach against you. It exploits scarcity and unbelievable discounts to get an impulse buy out of you without a second thought. We see these unbelievable deals on social media, in email, or in paid search advertising.

The common denominator is a price so low you could hardly expect to pay that on a popular item – the latest phone, high-end gaming console, or an item that’s otherwise sold out (in stores or online, before you could get it).

Warning signs

- High pressure and timers: The site uses countdown timers that flash, “only 2 left!”, and banners with high-pressure pitches that say the deal expires in minutes to limit your research.

- Only accepts payment via peer-to-peer (P2P) apps: The site only accepts Zelle, Venmo, or Cash App. These are designed for sending money to people you know and trust and offer little to no purchase protection. Legitimate businesses use secure payment processors.

- No reviews or recently created site: The site is brand new or, most oddly, has no customer reviews outside of a few generic buzz-worthy 5-star notes on the site.

Prevention measures

- Price check: Open a couple of tabs from 2 or 3 of the prominent, verified retailers. If what you found is in fact 50% or more less expensive than at any of those places, go ahead and assume you have found a fraudulent deal.

- Don’t buy on impulse: Take 10 minutes. If the deal is a valid deal, you will have time to decide without trying to hurry and take your money. Scammers are counting on you to purchase quickly and don’t like you to stop and think and do your own research.

- Domain age: Use a domain lookup tool to determine how long the domain has been registered. If it’s a few weeks or a few months old, it is a huge red flag that this is yet another pop-up holiday shopping scam.

9. Fake shipping notifications (smishing)

Smishing is phishing conducted via SMS (text message). During the holidays, you’ll receive Smishing is a message via phishing conducted using SMS (i.e., text).

As we approach the noted holidays, you will receive a text that appears to be from FedEx, UPS, or USPS (these are common carriers), telling you, “your package is waiting for a delivery update, click here,” or “we were unable to deliver your package, update your address here.”

A follow-up on the link will direct you to a malicious web page or automatically download malware.

Warning signs

- Un-personalized: The text is generic and does not identify you in the text, nor does it give any ordered information about an order number you could verify.

- Strange phone number: The text comes from a random 10-digit non-official phone number and not from an established short code that major carriers generally use.

- Personal data requested: The link takes you to a form that asks for information that has nothing to do with the delivery package, like your date of birth or your mother’s maiden name, both of which are identity thief markers.

Prevention measures

- Track your orders securely: When you receive a text message regarding your package, do not ever click on a link. Just open the retailer’s website or app yourself and check your order there. It’s a secure way.

- Block and report: Don’t let scammers bug you twice. Block the number right away and report that message as spam to your phone carrier.

- Keep things private: Turn off text previews on your lock screen so people can’t peek at your order info if your phone’s lying around.

10. Counterfeit goods scams

These scams are often tied to fake retailers or social media scams. The difference is that you do receive a product; however, it is a fake and/or unsafe product, not the luxury, branded product as advertised. This is especially true for in-demand electronic accessories, designer bags, or high-priced children’s toys in the busy holiday season.

Warning signs

- Images are blurry/stock photos: The images on the site may be slightly blurry or pixelated, or they could be stock photos with little to no branding, which supports that they do not have the item you want in stock (or available).

- No branded packaging/details: When you receive that good, there are no official tags, no branded packaging, there are small misspellings, or it has poor-quality stitching or materials.

- No seller customer service after selling: The seller’s customer service seems to disappear or is not helpful at all/responsive when you reach out to return or dispute the product’s authenticity.

Prevention measures

- Confirm or verify brand authorization: Check the brand’s site for an authorized retailer page. If they are not there, do not purchase.

- Use reverse image search: Just copy the product image from the ad, and run a reverse image search on Google. Often, you’ll see the same image with multiple questionable sites.

- Read the return policy: A legitimate business will have a clearly stated, comprehensive return and refund policy. Scammers either have a very poor one or none at all.

11. Holiday travel scams

The price of travel can be immense, particularly at peak travel times like the holidays, and scammers know that aggressive discounting will draw offers. Some scammers have created fake airline or hotel booking sites that may even spoof the URL of a real company.

These scams show hotel deals or flights at extreme savings or a free flight/trip to your favorite destination, and request a small payment to reserve the ticket and guarantee the price. Once you have paid, you will receive a form of a confirmation number, but when you get to the airport or hotel, you are going to realize you got nothing.

Warning signs

- Payment by direct transfer: If scammers ask you to transfer money directly to someone’s bank account or a person-to-person (P2P) app like Venmo or PayPal, this is a warning.

- No confirmation details: If the confirmation did not include an actual booking code or contact detail, you could independently check with the airline/hotel directly; this is also a flag.

- Poor website design: The original travel site has low-res logos, broken links, or generic, poorly written terms and conditions.

Prevention measures

- Always book direct: When booking flights and accommodation, it is best to book directly on the official website of the airline you are flying with, or the hotel chain website, or well-known travel sites (e.g., Expedia, Booking.com)

- Verify with the carrier: After you book, take a moment to call the airline or hotel. Use the public phone number on their official website to confirm your reservation with the confirmation number they gave you (double-checking stuff is always a good habit).

- Check for trade associations: If you are booking with a travel agent, check and ensure that they’re recognized members of an industry trade association, for example ABTA (UK) or IATA (Global).

12. Identity theft and account takeovers

This is typically the end goal for many/most scams (including phishing). Identity theft is when criminals gather enough personal data (whether it be passwords, SSN, DOB) to open new lines of credit, file fraudulent tax returns, or drain your existing accounts.

Account takeover occurs when a scammer has control of your existing accounts (whether it be email, bank logins, etc).

Warning signs

- Notifications: You get notifications about login attempts, password changes, or even new accounts being opened up in your name, which you did not authorize.

- Locked out from email/accounts: You try to log into your main email account or bank account, and suddenly you cannot access it – you have just had an account takeover.

- Unexpected mail: You receive mail from new credit cards or loans, and you did not solicit it. This is a huge red flag for identity theft.

Prevention measures

- Use a password manager: Get a good password manager to generate and keep secure different, strong passwords for all of your online accounts.

- Turn on MFA everywhere: Turn on multi-factor authentication (MFA) or Two-factor authentication (2FA) on everything related to money, shopping, and email. Doing so is critical for your security.

- Watch your credit reports: Check your credit reports often from Experian, Equifax, and TransUnion for free. This helps catch any weird stuff fast.

- Monitor the dark web: If you suspect your information has been stolen, it’s crucial to act fast. Our guide on what to do if your data is found on the dark web provides a step-by-step plan to contain the damage.

Pro tip: Often, the personal data stolen in these scams is quickly bundled and sold on the dark web, a hidden part of the internet where criminals trade stolen information. This turns a single scam into an ongoing threat.

13. Unsafe public Wi-Fi scams

During the holidays, lots of folks use free Wi-Fi at spots like airports and coffee shops to check their bank stuff, shop online, and read emails. Hackers know this and can easily do a man-in-the-middle attack. That’s not all; there are several other risks of using public WiFi, which we have discussed in this guide.

They can snatch the user’s social media passwords, credit card numbers, and anything else they are entering online.

Warning signs

- Unsecured network: Be careful if a Wi-Fi network doesn’t require a password or if its name shows a “Not Secure” warning (most of the latest smartphones give that warning). You’re connecting to a completely unsecured network.

- Fake hotspot: You are seeing many Wi-Fi network names that resemble the venue name (for example, “Starbucks FREE” and “Starbucks Official”), which could indicate that there is a malicious identical network established, and you are connected to the malicious one.

- Unexpected login screen: Sometimes, even on a network you trust, you might get an unusual login screen right after connecting that asks for way more information than normal.

Prevention measures

- Consider using NordVPN: Always use a secure VPN like NordVPN when you connect to a public Wi-Fi service. The encryption keeps your data hidden from anyone else on that network.

- Consider using trusted networks: Only do any activities that require your sensitive information (i.e., banking, shopping, login information) when you are connected to your home or trusted work network, using passwords to protect those connections.

- Disable auto-connect: Disable the auto-connect for Wi-Fi on your phone and laptop so you have to manually approve any Wi-Fi connections after service has expired, allowing the option to manually connect to an unsecured service provider.

14. E-card and holiday E-greeting malware

Scammers send holiday e-cards (greeting cards in electronic format), claiming to be from a friend, family member, or known company.

Often, the e-card has a link or attached file that, when clicked, will download malware, ransomware, or a keylogger to your computer that operates in silence, collecting your passwords or financial information, and giving those in control of the malware access to your confidential information.

Warning signs

- Sender is vague: The ecard shows an uncommon name, such as “Your Friend” or “A Secret Admirer”, and doesn’t specify the sender.

- File attachment: The ecard is an unexpected file attachment (.zip or .exe), which is more than an academic alerting potential malware delivery.

- Asks for personal data: The link takes you to a page requesting you to enter your email login or other credentials before you can “view” the card.

Prevention measures

- Verify the sender: Before you click, send the person who sent you the e-card a text or separate email asking them, “Did you send me an e-card?” If they say no, just delete suspicious emails right away.

- Consider trusted security software: Make sure you’re using reputable antivirus and anti-malware software on your device. Keep it (in fact, all your software) updated regularly, and allow it to scan and quarantine any suspicious startup files before they can run.

- Use text only: Do not open the e-card by inputting attachments or clicking any link included in an unsolicited holiday e-greetings. If the e-card of a holiday greeting does not display immediately and safely in your email or text, do not open it.

15. Grandparent/family in distress scams

This scam is a real heartbreaker. Scammers call, text, or email pretending to be a relative (usually a grandchild) who’s in trouble, such as being arrested or stuck somewhere. They’ll say they urgently need money wired to them for things, like bail or medical bills. It messes with older folks the most, but anyone can fall for it

Warning signs

- Fake emergencies: They make it sound like a super urgent, major crisis, so you won’t think straight or ask questions.

- Secrets: They beg you not to tell anyone else in the family, so you can’t check the story with someone you trust.

- Weird payment requests: They want you to send money in a way that’s hard to trace, like a wire transfer, gift cards, or even cash in the mail.

Prevention measures

- Make a code word: Talk it over and come up with a secret code word or phrase with family who might be at risk (like grandparents). If someone calls them pretending to be you, they should ask for the code word.

- Ask personal stuff: Ask the person calling something private that only a real family member would know. Like, “What was your first pet’s name?” or “Where did we go last summer?”

- Call them back: Just hang up and call the family member back on their real phone number – the one you already have saved.

The essential solution: Securing your connection first

Prior to jumping into the scams, let’s outline the very first step for the holiday shopping scams: securing your connection. Many of the threats mentioned above, especially those for public Wi-Fi or compromised websites, seem to rely on intercepting your data.

You need a reliable VPN that can do the job for you (keeps you safe from online hazards). A VPN creates a secret path between your device and the internet. It hides your info, so your ISP and online crooks on public Wi-Fi can’t read it.

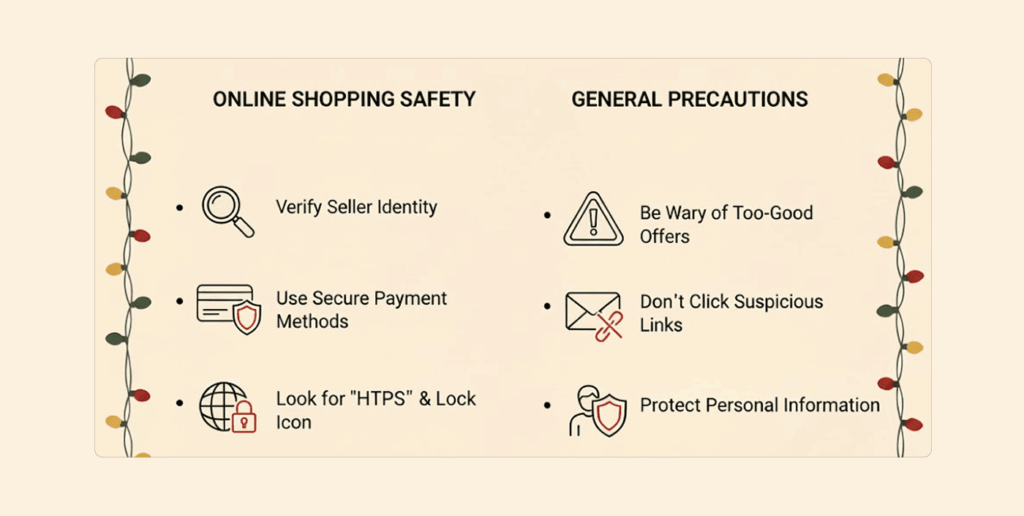

How to avoid holiday scams – Necessary preventive tips

While there may be a long list of holiday scams, safeguarding yourself against them does not need to be complex. Pursuing a few simple, focused solutions can easily keep you secure today:

1. Be sure to use multi-factor authentication (MFA) on everything

This can’t be emphasized enough. Enabling MFA on any financial, shopping (Amazon, eBay), and email accounts means that if a fraudster accesses any password, they cannot log in without the information generated on your phone.

MFA adds a layer of security that is separate from your password. Even if a phisher steals your password, they cannot log in without the second factor. This second factor is typically:

- Something you have: A code from an authenticator app (like Google Authenticator or Authy) or a physical security key.

- Something you are: A biometric scan (fingerprint or face ID).

Avoid using SMS for 2FA if possible, as SIM-swapping attacks can intercept these codes.

2. Use credit cards instead of debit cards

Credit cards offer Zero Liability Protection. This means once you report a fraudulent charge, you won’t be held responsible for it. Plus, disputing a charge is typically much faster with a credit card than with other payment methods. A debit card allows a thief direct access to your bank account; recovering your stolen funds will take a long time.

3. Protect your network with a quality VPN like NordVPN

When you’re out of the house, treat public Wi-Fi—all public Wi-Fi—as hostile. Always enable NordVPN (or any other quality VPN of your choice) before you log in to any public hotspot. This one step blocks hackers from getting your login credentials or payment info, securing your online holiday shopping from the ground up.

4. Pause before you pay

Scammers thrive on urgency. Be very suspicious of any message or offer that tries to rush you. If it says you’ll “miss out” unless you act in the next few minutes, that’s a huge red flag. Take thirty seconds to breathe and check the link and the official site. Rushing is the best friend of a scammer.

Were you scammed this holiday season? Here’s what to do

Getting scammed isn’t about being gullible. It’s about criminals using sophisticated tricks. All is well.

The most important thing is what you do next: if you’re suspicious or know you’ve been hit, act quickly to secure your accounts and warn others.

1. Stop all contact and preserve evidence

- Stop: Block the scammer’s number or email immediately. Do not respond to any further communication.

- Documentation: Make sure you screenshot all emails/texts/websites/chat logs with details of the date and time and how payment was made (e.g., “I sent $500 via Zelle on 11/05/2025”).

2. Secure your funds

- Contact your bank or credit card company: Call the fraud department immediately. If you paid via credit card, you can dispute the charge. If you paid with a debit card or through a bank transfer, your bank needs to freeze your account and examine your accounts for other scams.

- Reverse untraceable payments (if possible): For any gift card purchases, immediately call the card issuer (Amazon, Apple, Visa, etc.) to notify them of the fraud. For wiring or P2P “Zelle or Venmo,” you should contact that bank, as it may be possible to retrieve the funds if it is done very quickly.

3. Change and enhance your passwords

- Change right away: If you entered any login credentials on a suspicious website, change that password immediately and change any other accounts that have the same password. Make sure not to use the same or easy password, or you can read our this guide on how to create a unique password.

- Enable MFA: Turn on Multi-Factor Authentication (MFA) on any critical accounts (email, bank, social media) to lock the scammer out even if they have your password.

4. Report the crime to the authorities

By reporting the crime, you play a key role in helping authorities track these ruthless scammers and stop them from defrauding more people.

- Federal Trade Commission (FTC): Report the scam through the FTC here – ReportFraud.ftc.gov. This is the clearinghouse for consumer fraud in the US.

- FBI Internet Crime Complaint Center (IC3): If fraud occurred online or you lost a significant amount of money, report that to IC3.gov.

- Local police: File a police report. This is often necessary if you need to provide evidence to your bank or credit card company for a reversal.

- Delivery service/retailer: Report the fake account to the real company (like a fake Amazon email). So that they can warn their shoppers.

FAQs

The most prominent warning signs include any pricing that seems unbelievable; any phrasing or approach that makes you feel urgency, such as “act to receive this offer, or you will miss out,” or anything that requests to buy using a gift card, wire transmission, or cryptocurrency (your money put into an electronic password or erased). Real retailers will use conventional and traceable payment processors, while avoiding panicked selling.

Yes, as long as you have a good reputation VPN, like NordVPN, it adds another layer of protection against fraud. While a VPN will not prevent you from clicking on a link that you ferociously clicked on. A VPN is an essential protection from Public Wi-Fi Scams (Man-in-the-Middle scam) by encrypting all your information and stopping hackers on that network from being able to steal any information, including passwords or credit card information, while transmitting each of those orders.

Don’t type anything on the shady link’s page. If you just clicked the link and didn’t enter information, run a full virus scan on your device. If you clicked and put in your login or credit card info, change your passwords ASAP. Then, tell your bank or credit card company that someone tried to rip you off.

Yes, the e-card scams are still a problem – they are an effective method of combining a deliberate emotional hook with a dangerous payload. Scammers also use AI to make fake e-cards look particularly real. The preferred standard against this kind of scam still remains: do not open an attachment or click a link contained in an unexpected e-greeting card – and always make sure you can confirm with the sender (in person or increase your security level by using another system completely, such as a quick text message) before opening the e-card.